In my first blog post of 2018, I shared my thoughts on how I believe that this year might signal the start of an upswing in property prices and we might hit peak prices soon.

I also shared that I believed that the resale market might be the the focus of potential buyers who wish to enter the property market in 2018.

If you currently own a private property – congratulations! You might be one of the homeowners that might be the recipients of a very receptive buyer’s market.

New launches might not have the same appeal as the resale market due to developers launching at much higher prices.

What A Private Property Owner Can Do In 2018

Now if you currently own a $1 million property in Singapore, there are a few options you can take advantage of in 2018.

Assuming your property has appreciated over the past few years and you have passed the 4-year SSD mark, you could consider selling your property for a good profit.

(Remember paper profits are just that – just on paper! The best way to extract paper profits to real profits is by selling.)

Let’s look at a potential situation some owners might be in:

If your $1 million condo has appreciated by 10%, you would have made about $100K gain. We will also assume you have about $500K left in your outstanding loan.

Now let’s assume you have a $2 million condo that has appreciated by 10%, you would have made $200K gain. Your outstanding loan would be $1.5 million.

This is expected – a more expensive condo would mean a higher mortgage. But at the same time, you also would have made twice the gain.

So if you were a $1 million condo owner, what would you think of selling your existing home AND proceed to buy a $2 million condo?

The first reaction: Wow! That would mean I would have to service a much higher loan! No way.

But the other response could be: What if I made enough profits from selling my current home and set aside THAT profits towards paying for the mortgage for the bigger $2 million condo?

Is it possible that I could get monthly serviceable payments that is similar to what I am currently paying right now for the $1 million condo?

The answer is: Yes it is possible to get a monthly commitment that is the same as what you are currently paying right now but for a much more valuable property.

But the key is to be strategic and plan ahead.

And how I would do this is by executing 2 different steps:

Step 1: Selling your current property at the “FUTURE” pricing.

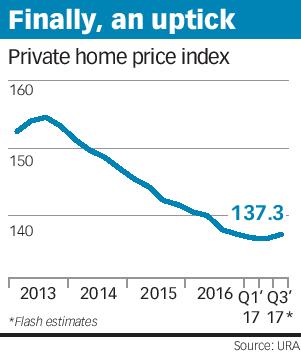

In the news article I shared above, property experts are expecting for resale property prices to continue to climb northwards. Buyers are currently turning to the resale market to get a home quickly.

Hence it is possible to get a very good price when you sell your existing property.

Step 2: Buy a property that is currently being marketed at “undervalued” pricing as your next home.

This step might require some hunting around for potential property that might be available at bargain prices.

Do such properties exist? Yes they do. I have seen quite a few of them.

Usually, such properties have some weaknesses. For example:

- distressed seller who wants to sell quickly

- poor response due to poor marketing which resulted in a price slash

- not in a great showroom condition but still fixable & liveable

From my past experience, to be able to secure such “undervalued” units will require some skilled negotiation and deeply understanding the seller’s intention.

It is not easy but it is not impossible either. 🙂

To sum up – my strategy would be to sell on future pricing, but buy based on past pricing.

However for these 2 steps to really work out well – the very first step will have to be executed very well.

How To Sell Your Existing Property At “Future” Prices?

To some cynical market watchers – it might be impossible and even silly. How is it possible to sell a property at future prices? But do take it from my own personal experience who had observed the various property cycles for more than 10 years.

I am on the ground enough times to know that it is possible – especially in this current upturn in the resale market.

From http://www.businesstimes.com.sg/real-estate/first-price-rise-in-four-years-backs-talk-of-property-rebound (3 Oct 2017)

The strategy is through powerful and effective marketing. A home – like any product – can be made attractive to its target market.

I have shared this in with great detail in my previous blog post – “Why Your Property Hasn’t Been Sold Despite Various Marketing Efforts?”

In that post, I shared what was a basically a detailed checklist on what to do and what NOT to do when you are selling your property.

I do apply and practice what I preach.

Recently I was given the opportunity to market a 1-bedroom penthouse located in District 10.

As you can see here, I had put in my fullest effort to ensure that I will get the best response for my marketing strategies.

Just for the videography work, I had to ensure:

- a full detailed script that described the unit’s best features (but that is not too long!)

- camera work that included a “model” for buyers to envision themselves living in the unit

- aerial camera work that included using a drone to capture panoramic views

In short, the video has to convey a sense of desire and longing in less than 3 minutes!

There were also a few other things that I had to do off-camera:

- Detailed home-staging to make the unit look better than an IKEA magazine

- Running FB and Google advertising campaigns to attract potential buyers

- Submitting the listing to various property portals

- Market research to understand who might be the most responsive target audience

Here are some data and clicks from one of my FB marketing campaigns:

Screenshot from a recent FB marketing campaign

People reached using FB ads

People reached using PropertyGuru listings

As you can see – using FB ads resulted in a much larger reach when compared to using PropertyGuru.

But I use both platforms to ensure I reach out to as many potential buyers as possible.

My goal is to secure a good and fair price for this unit.

My efforts from marketing this penthouse have yielded some positive responses so far. Here is one of them:

Response from whatsapp received

I practise such marketing strategies because I know it has proven to work.

I had put in similar efforts last year and achieved good results (and sometimes even at record prices).

Some of those transactions can be seen below:

I also wrote my experience in selling a $2 million property in just 21 days.

Conclusion

While I cannot promise “record-prices” for every property I am entrusted to market, I will take each new listing very seriously and put in my best efforts to ensure I can satisfy both seller and buyer.

Opportunities do exist in 2018 and some qualified existing home owners could consider making a move.

If you are considering to exit from your current property, I invite you to contact me for a discussion to find out your next possible options.

Leave a Reply